Beyond the $5B Inflection: Decoding the Intel–NVIDIA Partnership Across the Semiconductor Supply Chain

Assessing the Impact on NVIDIA, Intel, AMD, ARM, MediaTek, Astera Labs, and Semi-Caps

I’ve been traveling extensively across the U.S. and Asia over past few weeks and will soon be on another round of trips. Given the multifaceted impact of this partnership across several key semiconductor players, I felt it was important to get this piece out over the weekend. Also, if anyone plans to attend upcoming Intel Technology Tour, SEMICON West, or the OCP Global Summit, please feel free to reach out—I’d love to connect. I will likely be in South Korea for a week of vacation as well, starting from the end of October. Enough “rant,” let’s get it started.

Unexpected Intel-NVIDIA Deal

On September 18, NVIDIA (NVDA) and Intel (INTC) announced a broad co-development partnership covering data center and PCs, underpinned by NVIDIA’s $5B equity investment in Intel at $23.28/share (~4–5% stake). According to the statement, the collaboration will deliver x86 CPU + NVIDIA GPU tile systems for rack-scale AI infrastructure and new AI PC SoCs combining Intel CPU tiles with NVIDIA GPU chiplets. The announcement does not commit NVIDIA to Intel Foundry Services (IFS) for its GPUs.

TLDR: I personally view this as strategically positive for both companies. On one hand, NVIDIA broadens CPU compatibility in its rack systems, which should offer more options for its customers while equipping the company with a better ability to capture the AI PC market (and “low-key hit on its competitor AMD). It also expands its NVLink Fusion system further.

On the other hand, Intel is reclaiming relevance in AI servers and AI PCs through its collaboration with NVIDIA on future AI server racks and AI PC products. However, the deal’s impact remains back-end loaded, with clearer visibility likely emerging in late 2026 and into 2027, ultimately dependent on both companies’ co-execution and roadmap alignment, which we should get more details in coming quarters.

For the wider semiconductor ecosystem, the implications are quite nuanced. I see limited near-term foundry or WFE upside (and EDA), modest opportunities in packaging/test, and a recalibration of the competitive dynamics for AMD (AMD), Arm (ARM), and MediaTek (2454.TW). The following analysis will seek to unpack the impact on some of key affected companies by this deal.

NVIDIA: Expanding AI Server CPU Options and Advancing in AI PCs

For NVIDIA, I think the partnership reinforces its rack-scale platform control. By integrating Intel’s x86 CPUs into NVLink Fusion systems, NVIDIA can now offer hyperscalers a choice between Arm (Grace and future Vera) and x86 without conceding GPU/system control. This should also allow customers to have options in designing the racks, based on their workload and software demand. On the other hand, this neutralizes one of Intel’s longstanding ambitions—embedding GPUs into its Xeon ecosystem—and instead makes Intel a co-tenant under NVIDIA’s architectural framework. We will see how Xeon plays a role in Intel’s AI strategy in the future, but that’s the assessment as of today.

On top of that, the partnership also signals Intel’s entry as an official partner for NVLink Fusion, joining a roster that already includes Alchip, Qualcomm, Marvell, MediaTek, and, most recently, GUC (officially joined this month). This is unlikely to be a coincidence.

Rather, it reflects NVIDIA’s deliberate strategy to expand its ecosystem by leveraging its leadership in rack-scale solutions and its broader systemic advantage (I suspect Jensen sees this opportunity in this deal way ahead of the curve). Intel’s inclusion is simply the latest example of how NVIDIA is extending the reach of NVLink Fusion.

More NVLink Fusion see here from Irrational Analysis and NVIDIA (Link):

On the PC side, NVIDIA gains incremental tile attach in Intel’s AI PC roadmap, broadening its addressable market beyond discrete GPUs. This comes at a time when NVIDIA has already been working closely with MediaTek on Arm-based AI PC DGX Spark with GB10 Superchip. While revenue contribution is unlikely until 2027, the strategic benefit is brand entrenchment and platform optionality.

Beyond market opportunity, I see two key benefits from NVIDIA’s collaboration with Intel on AI PCs.

First, it provides NVIDIA with an additional x86-based platform for AI PCs beyond its Arm-based offering co-developed with MediaTek. Given the entrenched x86 ecosystem and the historical dominance of Intel/AMD in the PC market, this represents a pragmatic way for NVIDIA to expand its PC footprint. By contrast, Arm-based PCs have so far achieved rather limited penetration, making x86 a more immediate and scalable pathway for NVIDIA to capture market share (of course, under the assumption that: 1) Consumer buys what NVDA/INTC sell them, and 2) Product needs NOT to be lame).

Second, this has done two things for NVIDIA’s partnership with MediaTek. On a high level, it diversified the risk of only working with MediaTek’s Arm-based solution for NVIDIA’s future entry into the AI PC market. NVIDIA could also potentially leverage this new partnership to calibrate its AI PC partnership with MediaTek in terms of pricing, content share, roadmap alignment, and ecosystem positioning. In other words, NVIDIA can use Intel’s x86 engagement both as a hedge and as a bargaining lever to ensure its Arm-based partnership with MediaTek. MediaTek should also bear more pressure in the future, which I will address more comprehensively in the latter part of the piece.

Intel: Relevance Restored, but Execution Critical

For Intel, the agreement offers both strategic optics and incremental content. To start, Intel regains a presence in NVIDIA-dominated AI racks, with x86 CPUs once again in play for scale-up AI servers, where Arm has been a key player for NVIDIA (e.g., Hopper, Blackwell, and Rubin) and ASIC AI servers (Google, AWS, Microsoft, etc). This should at least put some pressure on future Arm’s penetration speed in AI servers over x86 and give little breathing room for Intel and its x86 share in AI servers.

Combining the points mentioned above, this deal will at the very least help Intel refresh its AI PC narrative by embedding NVIDIA GPU tiles into x86 SoCs, positioning the company as a credible challenger to AMD in AI-accelerated client devices. This collaboration could eventually help Intel counter some of the competitive pressure from AMD on the client side, though in the near term, I expect that pressure on Intel to persist. But overall, I have no doubt that this is a great upside for the Intel client business.

It is worth noting that Intel’s lack of a compelling “AI story” has long weighed on its share performance. The new deal with NVIDIA should help on that front. I am also positive about the future AI PCs jointly developed by two companies, but of course, execution and customer reaction will be key to watch.

On the foundry side, while Intel did not secure chipmaking orders from NVIDIA, the advanced packaging opportunity is noteworthy. NVIDIA’s support provides a significant confidence boost for Intel’s advanced packaging capability, and over time I expect some packaging orders to flow to Intel Foundry (as long as they can EXECUTE). This represents exactly the kind of concrete progress that both LBT and Intel Foundry have been aiming for.

Admittedly, it is still a modest step, but it could serve as an important stepping stone toward broader improvements in the foundry business.

Zooming out a bit, NVIDIA’s $5B equity injection should further stabilize Intel’s balance sheet in the interim, complementing earlier capital from SoftBank’s $2B investment and the U.S. government’s 10% stake acquisition.

That being said, I continue to see a couple of challenges remaining for Intel to navigate in the coming quarters and years. Intel’s server CPU competitiveness is not transformed by this deal; Xeon continues to face pressure from AMD’s EPYC in servers, as the latter has been eroding Intel’s share in servers. Nor does the collaboration resolve IFS’s chronic underutilization—NVIDIA made no commitment to source GPUs from Intel.

For Intel to capitalize on this deal for its foundry meaningfully in the long run, it must execute on advanced packaging (Foveros (likely) or EMIB). The success of Intel Foundry must start by proving its capability and execution to win back customers’ confidence by “small” things like this.

With strong execution and renewed confidence, Intel may begin hoping to attract more external orders for its chipmaking business, whether on 18A or 18AP.

AMD: The Pressure On

In my view, AMD is likely to be negatively impacted by the Intel–NVIDIA collaboration. In data centers, NVIDIA could capture additional AI server share by including x86-powered AI servers within its architecture. At the same time, the inclusion of Intel’s x86 CPUs in future NVIDIA AI servers should at least help Intel defend—and potentially expand—its overall share of the x86 market against AMD.

On the client side, Intel and NVIDIA’s plan to co-develop AI PC SoCs represents another clear headwind for AMD’s client business. Up until now, AMD’s integrated Ryzen + Radeon platforms had positioned it as the natural alternative to Intel and were steadily “eating Intel’s lunch” in client PCs. However, a co-branded Intel–NVIDIA solution is likely to attract customers and OEMs that value premium branding, software ecosystem support, and NVIDIA’s developer reach. From a product perspective alone, an AI PC combining Intel CPUs with NVIDIA GPUs should be competitive against AMD’s current offerings. This suggests that AMD will face greater competitive pressure in the client market going forward.

However, I think the threat to AMD is not imminent in the short term, and the extent of impact remains to be seen depending on the execution from Intel and NVIDIA. Additionally, the shipments from this partnership will not meaningfully ramp probably until 2027, given the needed time for new product development and getting supply chain ready.

Nevertheless, the competitive overhang is real and should be a concern in investors’ minds.

ARM and MediaTek: Mixed Signals

For Arm, the Intel–NVIDIA collaboration marginally tilts the narrative back toward x86, tempering some of company’s near-term momentum in AI servers. One reasonable concern is that some future NVIDIA racks may be equipped with x86-based CPUs, which will in turn take some NVIDIA AI server share from Arm. Another concern is Arm’s presence in NVIDIA’s future AI PC roadmap, which is also Arm-based. Personally, I think the first concern is rather manageable, with the latter a bit more concerning.

While the former could modestly reduce Arm’s share in AI servers, I don’t see a scenario in which NVIDIA abandons Arm architecture in its future roadmap (at least I haven’t seen one YET, and see Jensen’s comment in the call below). For example, given that NVIDIA’s VR300s should still be around 2027 and even early 2028, Arm's status as NVIDIA's beneficiary should be extended until then.

Beyond NVIDIA, it is reasonable to expect ARM to remain the preferred option for hyperscaler ASIC servers, including those at Google, AWS, and Microsoft (and will not be surprised if more ASIC servers choose Arm over x86 in the coming years). As these custom AI servers further scale and mature, ARM can capture further share gains in the overall data center market.

Personally speaking, the Intel–NVIDIA announcement does little to alter two major upside I see for Arm in data center trajectory—1) Its dominance in NVIDIA’s AI server, and 2) Its increased presence in ASIC AI Servers that will further scale and mature in the future (*not saying all the ASICs will succeed tho).

It is also important to point out that, at least for now, the data center is far from a major business segment for Arm’s portfolio in terms of revenue contribution (but will be a key narrative and growth driver for the company moving forward for investors).

One should also know that Arm has already secured little more than 10% of overall data center CPU share through Q1 of this year and nearly 20% among hyperscalers—a significant improvement versus just 2–3% share two to three years ago. This number could go higher given the trajectory mentioned.

I have greater concerns around AI PCs on Arm. As noted in the Intel/NVIDIA section, Arm-based PCs have seen only limited success compared to x86. NVIDIA’s decision to partner with Intel on future AI PC development could further pressure the Arm PC ecosystem, even though Jensen has reiterated a commitment to the Arm roadmap.

With that in mind, the Intel–NVIDIA partnership also increases pressure on MediaTek, which has been co-developing Arm-based AI PCs with NVIDIA. The best-case scenario for MediaTek is market segmentation—maintaining share in Arm laptops while coexisting with NVIDIA/Intel x86-based AI PCs. However, it is difficult to rule out the possibility that the Intel–NVIDIA AI PC platform will ultimately pressure MediaTek’s positioning and limit the success of its Arm-based products.

The worst possible outcome of this partnership for MediaTek and Arm would be NVIDIA going “all in” on x86 AI PCs—something that has yet to happen, with limited signals pointing in that direction (as of now).

One more point that few have mentioned is that this Intel/NVIDIA thing may also be unfavorable news for Qualcomm (QCOM), which has been hoping to capture a larger share of the PC market with its Arm-based offering but with quite limited results.

More about Qualcomm’s diversification efforts in PC can be found in this piece by Irrational Analysis

TSMC: Status Quo Maintained

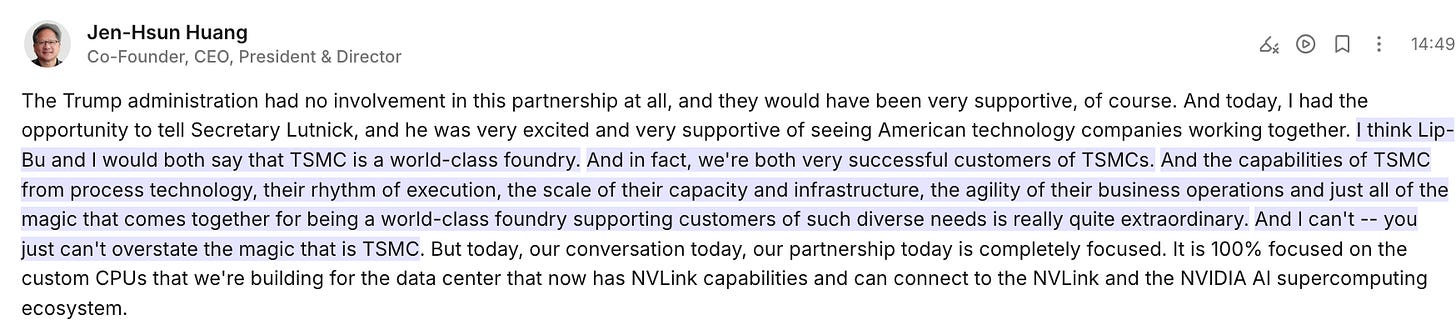

Despite speculation, NVIDIA has not shifted GPU production to Intel based on my understanding of the new partnership. TSMC remains the most important supplier of NVIDIA’s leading-edge GPUs and CoWoS packaging. I believe TSMC’s technological lead in both process technology and advanced packaging should ensure it remains insulated from the impact of this deal and continues to hold a favorable position over Samsung and Intel in the overall foundry landscape. Notably, during the call co-hosted by LBT and Jensen, both explicitly acknowledged TSMC’s capability, referring to it as a ‘world-class foundry.

A potential future risk for TSMC would be if NVIDIA were to source wafers from Intel’s foundry, which would represent a major strategic shift. However, as of today, I have yet to see an indication of such a move. But again, there is no doubt that Jensen’s endorsement of Intel’s advanced packaging is a timely boost for Intel Foundry—reinforcing Intel’s technological capabilities and providing much-needed confidence. And again, time for Intel to execute.

Some may have a knee-jerk reaction to view this as a negative for TSMC, but that may not be the case. As Intel’s financial position improves and its product portfolio strengthens in the coming years, this partnership could actually represent an upside for TSMC, given that both Intel and NVIDIA remain its key customers. I see potential for incremental chip orders flowing to TSMC, though we do not rule out the possibility that a portion of production could be allocated to Intel’s foundry. The market reaction supported my view, with the stock initially dropping before recovering by the end of the day.

Astera Labs: PCIe Headwinds Possible, Extent Yet to Be Determined

The Intel–NVIDIA deal’s impact on Astera Labs (ALAB) ultimately hinges on how NVLink Fusion reshapes the role of PCIe in future GPU rack architectures.

NVIDIA’s extension of NVLink Fusion into the x86 CPU domain introduces some risks for ALAB. Today, ALAB derives meaningful revenue from PCIe Retimers, which enable communication between CPUs and GPUs over PCIe. If NVLink increasingly replaces the traditional PCIe link between x86 CPUs and NVIDIA GPUs, demand for PCIe Retimers could decrease.

That said, ALAB has been listed as a partner in the NVLink Fusion ecosystem since the architecture was first announced, suggesting it may still retain content in next-generation platforms—though the specifics remain unclear and any material revenue impact is likely still a few years out.

More importantly, market attention has already begun to pivot toward ALAB’s Scorpio Switch, a product designed for rack-scale connectivity, which could become its more defining growth driver as PCIe Retimer demand normalizes.

For more ALAB content, see the fantastic analysis (paid) by AYZ this August.

Semi-Cap: Limited Near-Term Upside

Lastly, the semi-caps. The lack of a foundry sourcing agreement implies minimal incremental wafer starts for IFS and, consequently, no near-term lift for wafer fab equipment suppliers (especially the front-end players). IFS’ 2026 capex remains projected to decline, muting order visibility for Applied Materials (AMAT), Lam Research (LRCX), Tokyo Electron (8035 JP), and ASML (ASML). From a financial standpoint, IFS, with a stronger balance sheet, should undoubtedly be positive news for semi-cap partners in its ecosystem. That said, upside for equipment vendors remains limited as long as we don’t see capex rise for Intel in the coming years. It was a little surprising that these stocks reacted positively to this partnership.

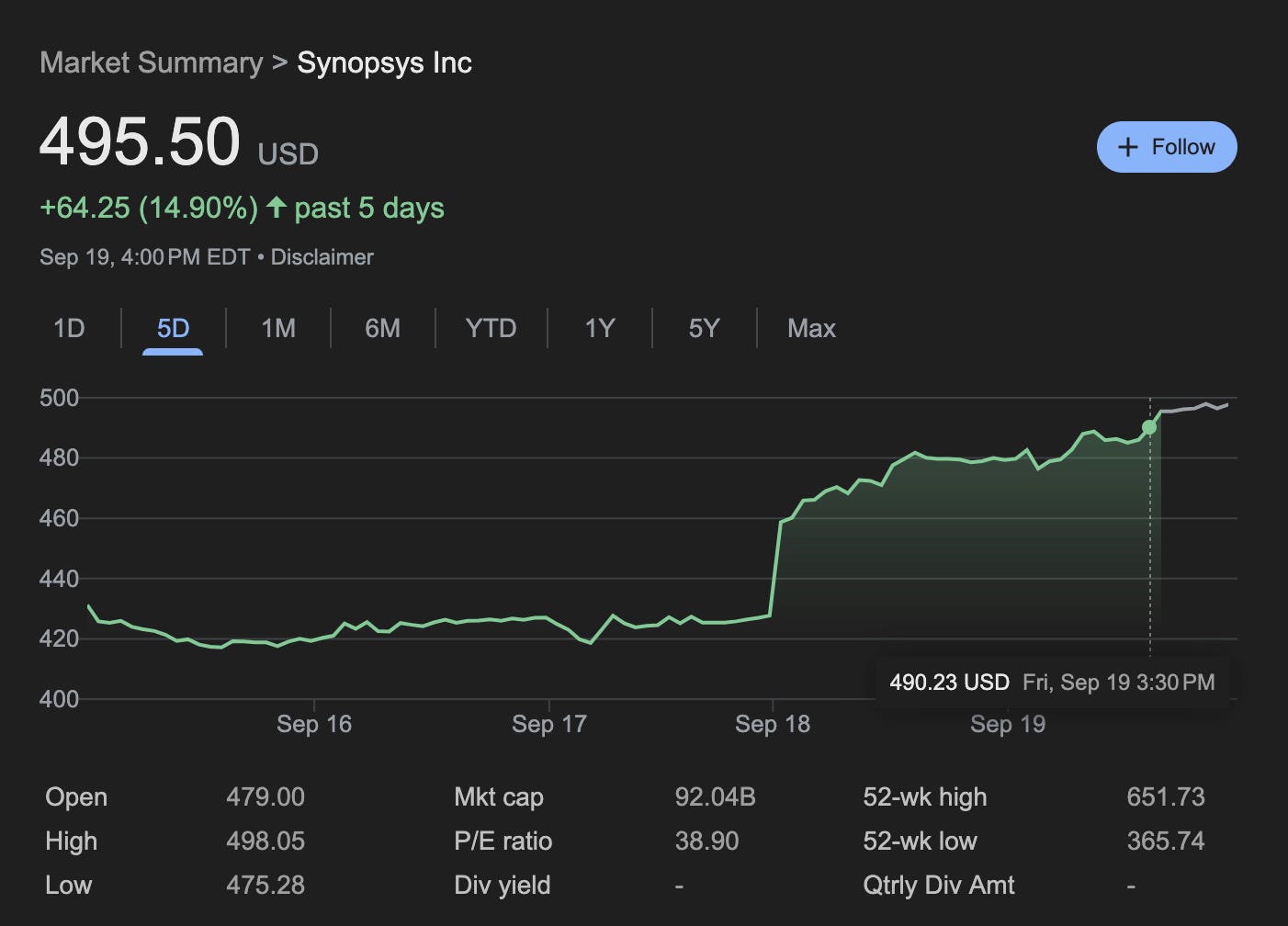

Intel’s key IP/EDA partner Synopsys (SNPS) also traded higher on the news (after the firm’s share got “destroyed” after last earnings by -35%). While Intel's stronger balance sheet is positive news for the company, I believe investors should be cautious in assessing the potential upside of this deal for Synopsys, given Intel’s foundry struggle.

One aspect of implication that may be overlooked in this deal is packaging and its implications for semiconductor equipment. Since the deal suggests Intel is going to get some packaging orders in the coming years, I think it could benefit supply chain semi-cap partners for Intel’s packaging and testing.

To be fair, tho, it remains unclear how the market will price in, given the limited visibility on packaging orders and the “wait-and-see” around Intel’s execution in advanced packaging at this stage.

Lastly, let’s give some credit to Intel's LBT (and Jensen as well). As I said, Bro is on the mission to save the company, and no doubt he is a legend in semis.

This is very interesting. Would you be interested in guest posting this on my newsletter

Who do you see as the biggest semicap beneficiaries? FORM?