Micron FY25 Q4: Testing the Limits

Easing HBM4 concerns and a supportive memory cycle should continue to benefit the company in the near term, and searching for top beneficiaries of the cycle

Micron’s (MU) earnings this quarter have a lot to unpack, particularly given the developments across the memory landscape—spanning HBM, DRAM, and NAND—as well as the key technical and market details the company provided regarding its HBM. It also takes me about a day more to think through these earnings while reading the transcript carefully.

*Also, if anyone plans to attend the SEMICON West, or the OCP Global Summit, please feel free to reach out—I’d love to connect. I will be in South Korea for a week of vacation as well (first week of November)

Before we dive in, I recommend reading the short Micron preview (link) I published yesterday—it will provide helpful context for the assessment I’m about to share on Micron this quarter. Also, follow my X (link) here to get timely insight & news on semis.

TLDR:

Micron had a strong quarter (hard to say otherwise), surpassing expectations across key fundamentals, supported by the ongoing “memory supercycle” in DRAM and NAND, alongside continued momentum in its HBM business—positioning it as a key beneficiary of the rapidly expanding AI inference and broader compute demand.

Overall, management’s commentary was broadly positive, validating much of the market’s assessment on the DRAM and NAND businesses—some of the key drivers behind Micron’s recent rally. Despite that, we need to pay close attention in coming quarter to see if there is any crack in such memory cycle, whether in NAND or DRAM, that should have material impact to Micron’s business.

On HBM, management expressed strong confidence not only in the technical capabilities of HBM4, but also in its ability to ramp production and capture market share at a faster pace than HBM3E. They also addressed customer concerns regarding specification changes on HBM4, suggesting those issues are largely under control—a positive signal for HBM4 product timeline. It also reiterated confidence that its HBM4 supply will be fully sold through in 2026, while acknowledging that negotiations with customers remain ongoing and have yet to be finalized.

Despite the positive commentary, investors should closely monitor Micron’s HBM4 production timeline, as the recent specification change—while management insists it remains on track—still warrants caution in case of potential impacts of spec change on the production (Follow my X/Twitter here so you can get timely coverage on this), which the management seems to avoid addressing in my view.

Looking ahead to 2026, management raised capex guidance to $18B, up roughly 30% YoY from $13.8B in 2025, with the majority earmarked for DRAM construction and equipment. Later in this article, I will discuss which players are best positioned to benefit from this investment in the long run.

DRAM: Accelerating Cycle

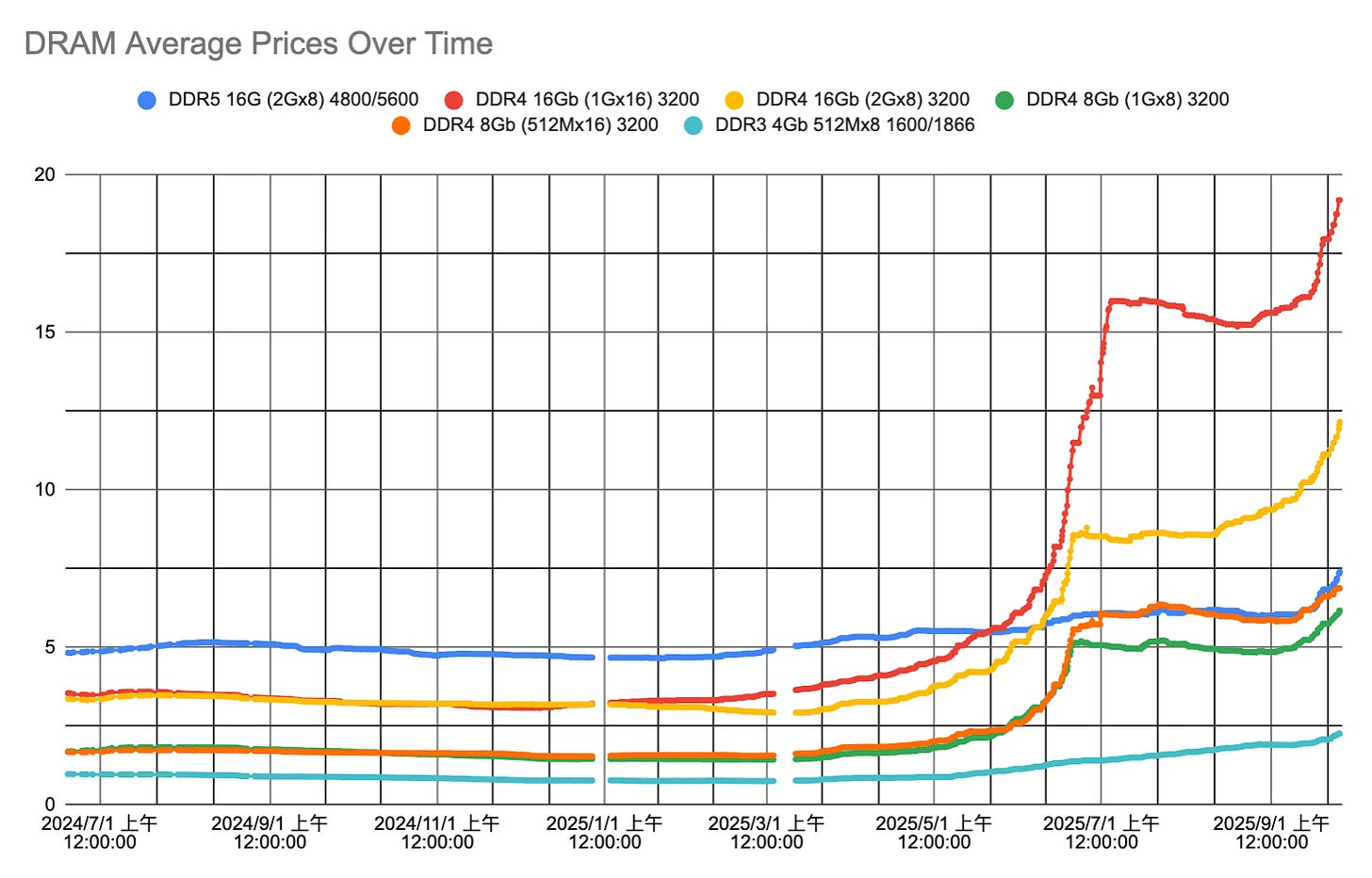

In my preview piece (link), I highlighted Micron’s favorable positioning in DRAM, underpinned by a sharp improvement in DDR4 and DDR5 pricing (see graph below) since June—what some investors have dubbed a “DDR supercycle.” Momentum has been further bolstered by its HBM business, which I will address later in this article.

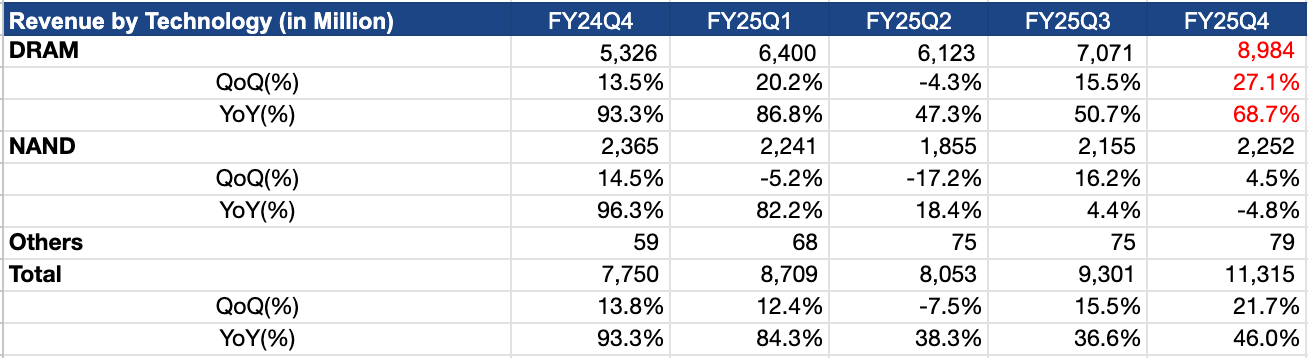

Micron’s FY25 Q4 DRAM results came broadly in line with these expectations, reflecting the stronger pricing environment and tilting supply/demand dynamics. DRAM revenue reached $8.9B (+68% YoY, +27% QoQ), representing approximately 79% of total company revenue. The firm’s quarterly gross margin also improved from last quarter to 41%, which should have been helped by the DDR pricing improvement.

Investors should well capture the upward trending DDR cycle, which is one key reason for the stock’s sharp rally—up more than 30% in the past month and over 60% in the past six months. The improvement in the DRAM business is critical, as DRAM (including HBM) accounts for nearly 80% of the company’s total revenue.

Before moving on to NAND, it is important to highlight, analyze, and explain the catalysts behind the DDR price shift.

For paid subscribers: In the context below, I’ll dive deeper into the DRAM and NAND cycles—covering both technical and market dynamics down to the model layer—and walk through how these cycles have propelled certain stocks “to the moon” in a short period of time.

I’ll also assess Micron’s positioning, earnings, and key developments in NAND and HBM, while highlighting the companies best positioned to benefit from this memory upcycle.

Keep reading with a 7-day free trial

Subscribe to SemiPractice to keep reading this post and get 7 days of free access to the full post archives.